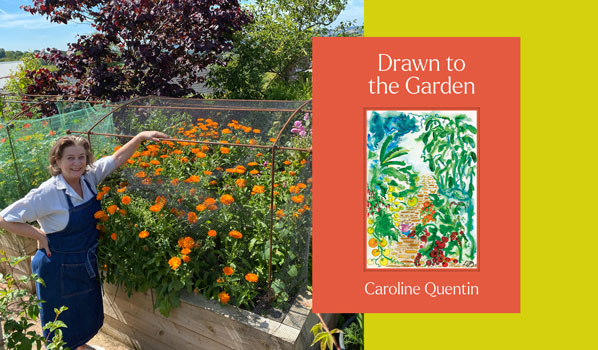

The Men Behaving Badly and Life Begins star, who recently appeared in Sky sci-fi series The Lazarus Project, also offers a wealth of advice and tips to her 150k followers on Instagram (@cqgardens).

Her husband, Sam, does much of the filming when she invites followers into her home near Tiverton in Devon, where she makes all sorts of dishes from ingredients she has grown, and shows us what she’s up to in her two-acre garden – which features an orchard, pond, greenhouse, raised vegetable beds and a flower garden, where the magic takes place..

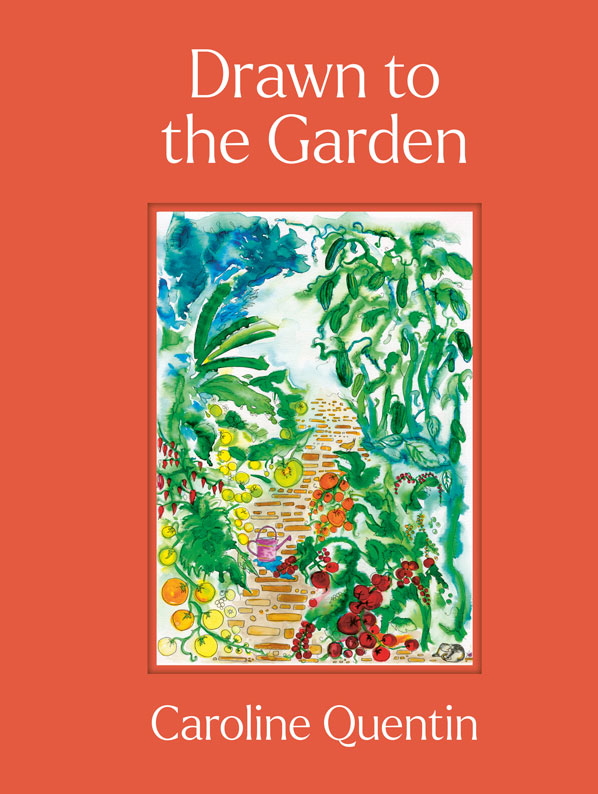

Now, Quentin has written – and illustrated – a new book, Drawn To The Garden. It’s part memoir, part guide, with chapters on seeds, salads, fruit and veg, water, herbs, pets and pests, memories and anecdotes meandering through each section.

Her garden, she says, is “not immaculate”. Weeds haven’t taken over, but she allows some buttercups and daisies to encourage bees.

“By my nature, I’m quite a chaotic person, so I don’t need things to be immaculate, but my vegetables are in a rotational system. I’ll mow a path through the grass rather than cut all the grass. I garden organically.”

The book also features a chapter on wellbeing, an important element to Quentin, whose mother suffered from bipolar disorder and spent periods in a psychiatric hospital, she recalls in the book.

When she was allowed to visit, she’d spend time in the hospital gardens, surrounded by marguerites, which she still loves.

“I genuinely believe that growing things, watching the birds, smelling the roses, eating the green stuff and drawing and painting, all help keep me this side of sanity and one step away from the big dark house on the hill,” she writes.

Here, she tells us more…

How much has gardening benefited your mental health?

“I consider it responsible for my wellbeing. I am by nature someone who goes up and down. I have mood swings, I get low. And if I do feel low, the first thing I turn to is my garden, or if I can’t be near my garden, the nearest open space or natural environment.”

Did you always have access to a garden?

“As a little girl, we had a long strip of suburban terraced house lawn. It was not really a gardening space. Nobody in my house was particularly interested in gardening.

“I wouldn’t say I was a gardener when I was young but at primary school, I’d put a seed on a bit of blotting paper or a bulb in a jam jar with water underneath and it was fascinating. The whole optimism about growing things is always a good thing.”

What was your garden in Devon like when you first moved there?

“It was a derelict property, with just a field and a trickle of stream at the bottom. There was no garden. That was about 17 years ago.

“I put the pond in first because I knew when you put water into a garden, nature comes, and that was what I was most interested in. It was one of the most exciting things I’ve ever done with a garden. I swim in it too.”

How do you juggle your acting career with looking after the garden?

“You tend to film in the summer months, and gardening obviously happens a lot in the summer months as well. So I tend to be in the greenhouse in January, February and March, getting everything ready, sowing my seeds, getting the garden ready, and then suddenly the phone will ring and I’ll need to be away from the garden when everything needs to go in and be planted out. Being an actor and a gardener is not really a happy combination. The time balance is somehow wrong.

“I’m filming two dramas this year. I do get homesick. I’m really bad at being away from home, which is weird given that I do it for 90% of my life. But it’s a small price to pay for what has been a very enjoyable career.”

Do you have help?

“Sam will water for me, but he’s not a gardener. Anthony (her gardener) has helped me over the years. He comes in for a morning a week.”

How do you maintain your wellbeing in the garden?

“I hug trees, I talk to trees, I spend as much time as I can in woodland. They call it forest bathing. It’s a deeply rooted human thing to want to be in the shade or dappled light of a tree on a summer’s day.

“I don’t formally meditate, but I do have a process where I try to breathe well when I’m outside if I’m feeling stressed or trying to learn some lines and they’re not going in, or there’s too much to do. I do a little bit of yoga every day. In the summer, I can do that outside and get my breathing organised to just slow my heart rate down and breathe in some good air.”

What’s next?

“I’m planning to downsize and start a new garden (in Devon). My children (Will and Rose) have left home and we have a big house and big plot of land. I’m getting older and maybe it’s time for me to start thinking about a garden for someone in their 60s. I want to make my next garden as well, I don’t want to inherit one. At the moment I’m fixated on having bees. So I’m thinking of an orchard with bees in it, and possibly some wildflowers.”

What will you take from your old garden to your new garden?

“Probably water. What’s brought me the most joy is watching swallows over the pond on a summer’s evening. I would definitely grow apples again and I would have maybe three or four raised beds, and a greenhouse or potting shed.”

Drawn To The Garden by Caroline Quentin is published by Frances Lincoln on February 15, priced £20.