Thinking of making home improvements, or buying a more energy-efficient home? Green mortgages may be able to help, writes Vicky Shaw.

Many of us are trying to do more to help the environment nowadays. Perhaps you’re trying to reduce your household waste, recycle more, and find more eco-friendly places to buy items from.

And if you’re a homeowner, there could be some upgrades you can make to your property, to make it a bit more eco.

You may need to borrow more money to make your home ‘greener’, or you may be buying a home with a high energy efficiency rating – and that’s where green mortgages can come in.

Sustainable home improvements can be good for your wallet, as well as the environment. For example, someone could potentially save on their heating bills over the long term by having their windows replaced or reconditioned.

And with green mortgages, you may also find you can get a lower borrowing rate.

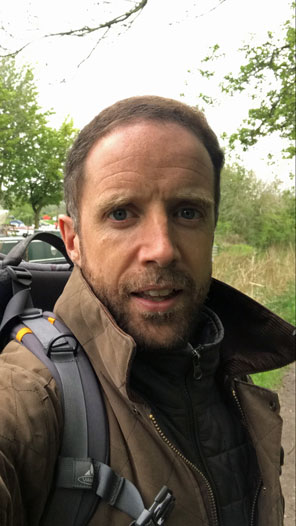

To find out more about green mortgages, we talked to James Pagan, head of mortgages at Nationwide Building Society…

What are green mortgages?

Pagan says green mortgage products tend to either encourage people to make their existing property more energy-efficient, or reward them for buying a property with a high energy efficiency rating.

In terms of mortgages which help people make their existing property greener, he adds: “A lot of people don’t necessarily buy a house on its energy efficiency. They buy it for other factors, such as location, space, garden. And once they get in there, they often think: ‘OK, well how do I make the most of the home that I’ve bought?’”

What sort of home improvements can green mortgages cover?

This could depend on the individual lender, but Nationwide’s Green Additional Mortgage can be taken out for a wide variety of upgrades – including new or upgraded windows, solar panels, boiler improvements, insulation including pipe and boiler insulation, air source heat pumps, electricity or lighting upgrades, rainwater harvesting, electric car chargers and small-scale wind turbines.

One couple from Bolton in Lancashire, for example, borrowed £25,000 to improve their home and installed a new warm, insulated roof on their orangery.

What green mortgages does Nationwide offer?

Pagan says Nationwide has a Green Additional Borrowing mortgage for existing members, who already have a mortgage with the Society. The fee-free mortgage has the Society’s “best” rate, at 0.75%, and people can borrow up to £25,000, depending on individual circumstances. The deal is available at up to a maximum of 85% loan-to-value (LTV) and the 0.75% rate is the same for all eligible borrowers, regardless of the LTV.

To qualify, at least half (50%) of the additional borrowing must be spent on energy efficient home improvements. The mortgage term of the additional borrowing can’t be longer than the existing main mortgage term.

And for existing or new members buying homes with high energy efficiency ratings, the Society offers cashback of up to £500 under its Green Reward scheme. This is available for existing homes and new-builds and flats as well as houses, with further details about the criteria on Nationwide’s website.

The schemes are part of the Society’s commitment to ensuring 50% of its mortgage book is rated EPC-C or above by 2030. Landlords can also benefit, with Nationwide’s buy-to-let arm, the Mortgage Works offering Green Further Advance mortgages for landlords.

Why has Nationwide introduced green mortgages?

“It’s linked into our core purpose, so we were created as a building society movement to get better quality housing for everyone,” says Pagan. “Take-up is improving all the time.”

The Society has also been working to minimise its own environmental impact, and is now carbon neutral in energy use and emissions for all internal operations and company vehicles, and uses 100% renewable electricity.

What other deals are on the market?

While the popularity of green mortgages could increase in future, Rachel Springall, a finance expert at Moneyfacts.co.uk, says products are still “rather niche” across the market generally.

“But some major lenders are already on board to offer a discounted mortgage rates to borrowers who purchase an energy-efficient home,” Springall adds. “This fact alone provides much optimism for more lenders to offer a similar approach.”

She highlighted Virgin Money, which recently launched Greener Mortgages – offering lower rates of interest to customers buying energy efficient new-build homes.

In a survey, Virgin Money found tackling climate change is important to 78% of people, and the pandemic has made over a third (34%) think more about their environmental impact.

NatWest has also launched Green Mortgages, offering discounted rates to those purchasing an energy efficient property.

Springall said: “It is vital borrowers seek advice when comparing deals, to ensure they can meet eligibility criteria and not be left disappointed.”