Residential property sales saw a notable uptick in January at McCarthy Holden, with contracts being exchanged and new sales being agreed.

Luke Parkes runs the country house department from our Hartley Wintney branch and in the last week some examples of the top end market activity included another property sale exchange on The Ridges, Finchampstead at circa £1.9m., and a new sale agreed on a £5.250m. property in Finchampstead on the Berkshire / Hampshire borders. The video below shows these specific properties.

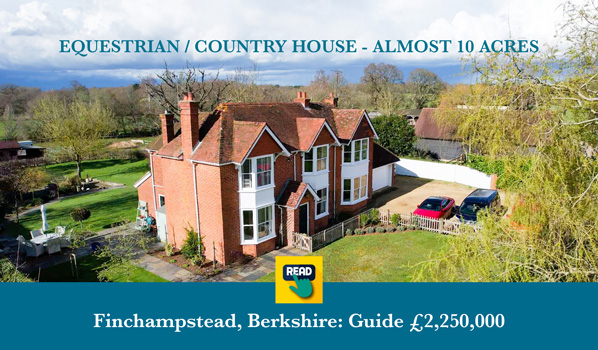

In addition, yet another insight into market activity in the higher end sector was witnessed when he put the property below live to the open market on Friday last week, only to receive and offer on the every first viewing.

Right now Luke Parkes is encouraging anyone thinking of selling in the £1.5m. to £5.0m. sector to contact him and discuss the possibility of coming to the market early this year to take advantage of the buyer interest currently in place. For further information telephone 01252 842100 or email [email protected]