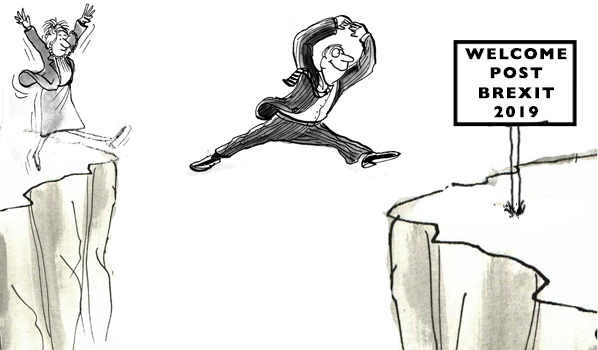

There are two events that are likely to happen by the end of 2024 and both could have a profound impact on the house market.

The first is the likelihood of interest rates starting to tumble during the second half of 2024, which in itself will have a positive impact on stability in the UK residential house market, perhaps even resulting in some recovery in house prices.

The second is the likelihood of a Labour party being in Government and the impact on the house market is not as obvious, unless you have prior experience or the ability to navigate some research.

So, to help our readers, here are some thoughts.

Our most experienced senior director has personal experience of around 50 years in estate agency, and believes that in the short to medium term a Labour Government is likely to give a boost to the UK residential property market as it has done in years past. This may come as a surprise to market watchers as the Conservative party has traditionally styled itself as the “party of homeownership”

But you don’t need to take our opinion, because real house price growth in the last five decades has risen the most under Labour governments, while four out of the five governments that presided over falling house prices were Conservative, according to a recent report by the buying agency Middleton Advisors’

Analysis also shows that the Labour prime minister Tony Blair oversaw the period of greatest growth in the housing market, with prices increasing by 9 per cent per year on average during his Leadership. Between June 2001 and May 2005, when Blair was prime minister, house prices increased by almost £48 a day. Under John Major’s Conservative government, which started during a global recession in 1990, house prices increased by just £3 a day.

Let’s be clear, in the past Labour was lucky enough to preside over more periods of economic prosperity than the Conservatives and it was not their policies that was impacting the strength in the house market. Indeed it wasn’t that long ago that there was panic in some quarters about Labour housing policies and especially the prospect of a Jeremy Corbyn led Government, with his hard left interference with the property / land market (Land For The Many Paper) which no doubt cost Labour the last General Election.

The Labour party has recently released date showing that two thirds of children born in 2023 won’t own a home before their fifties – and has said that it’s aiming for 70% home ownership. To reach this target, it proposes introducing a mortgage guarantee scheme and increasing the stamp duty surcharge for foreign investors. We’ll see.

But moving away from policies, the reality is that the main influence of a healthy property market is a stable and sound economy and, with the likelihood of Labour being in power some time next year, combined with the historic antidotes of inheriting a good economy, then on balance a Labour Government will be good for improving the house market.

So what should a house buyer do with this potential scenario? The answer is simple, try to make your house buying decision in the first half of 2024, whether you are a first time buyer or seasoned house mover. Start your 2024 house search.