Essential excerpts:

This legislation imposes duties on landlords to have an electrical installation inspection and test, carried out by a qualified person, at least every 5 years. Other duties include:

i) Obtain a report from person conducting the inspection and supply this report to the tenant within 28 days of the inspection/on date of occupation by new tenant/and prospective tenant on request.

ii) The landlord must also supply the local housing authority with a copy of the report within 7 days of receiving a request for a copy.

iii) The landlord must retain a copy of the report to give to the inspector who will undertake the next inspection.

iv) Where the report identifies remedial work, the landlord must complete this work within 28 days or any shorter period if specified.

v) The landlord must supply written confirmation of the completed remedial works to the tenant and the local housing authority within 28 days.

vi) If the local housing authority finds that landlords are in breach of their duties they may impose a fine up to £30,000.

How to comply:

If we fully manage your property, and your property falls under the first time period requirement, then as part of our ongoing compliance we will be organising this over the coming couple of months. If you wish to arrange your own electrical inspection, please inform us by 22nd of May that this is your intention.

We have been speaking to Pinnacle Electrics who carry out the majority of electrical work for McCarthy Holden managed properties and they have provided us with the following pricing structure to complete the inspection and report to the required standard:

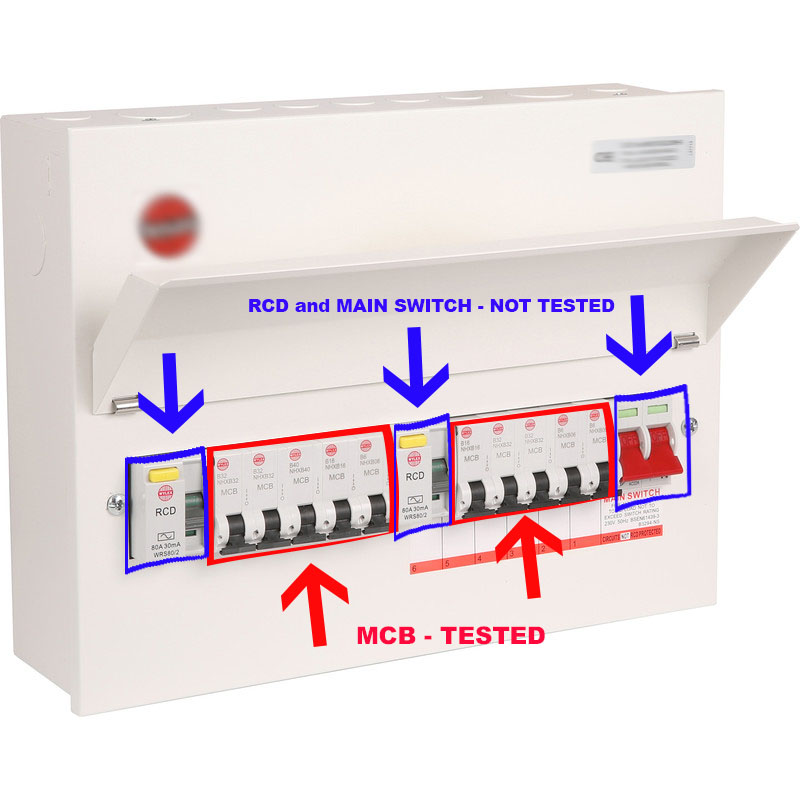

- Initial charge – (assessing the consumer unit, incoming supply, protective bonding etc) £118.80 inc vat (£99.00 +vat)

- Subsequent charge per MCB* (each Miniature Circuit Breaker requires testing) £27.60 (£23.00 +vat)

*Please note that in general most properties have between six to eight MCBs

Please see Appendix 1 below for further information

Where Pinnacle Electrics are unable to undertake the works for any reason, we shall endeavour to source a similarly priced electrical contractor who is qualified to carry out such checks in the same way.

COVID-19 implications:

Currently, there has been no alteration to dates expected in the regulations and as such we need to prepare and proceed with the inspections and ensure procedures and precautions are taken by both inspector and tenant.

Pinnacle Electrics have provided us with their Covid-19 policy (please email Danielle Goodyear if you would like to review). The highlights are social distancing will be observed, latex gloves and face masks will be worn from the beginning of the visit and discarded safely at the end, anti-bacterial gel is used before and after gloves. We will also be asking tenants to follow similar steps and to prepare the area to minimise contact on objects from the inspector.

Property management service variances:

If your property is not managed by McCarthy Holden you will still be required to undertake this work and provide us with a copy of the report as soon as completed together with proof of rectification works.

If we currently collect the rent for you, we can also organise for the inspection and report to be carried out so please contact Danielle Goodyear in property management.

Should you have any questions in relation to the above, please do not hesitate to contact us.

Yours sincerely

Nicky Bremner (MARLA)

Lettings Director

01252 622550

Appendix 1.

Miniature Circuit Board (MCB) in red tested and under subsequent charge

RCD and Main Switch in blue not tested seperately.